About Us

Corporate Press

Our vision is to provide socially enabled cross-border financial services that help immigrants stay connected in ways that matter.

Local Focus

Global Reach

49

States

86

Beneficiary Countries

1,000+

Agent Locations

49

States

86

Beneficiary Countries

+700

Agent Locations

Conformity

Compliance

Philosophy

The engagement of every individual in an organization, regardless of department, is the pre-requisite to ensuring compliance.

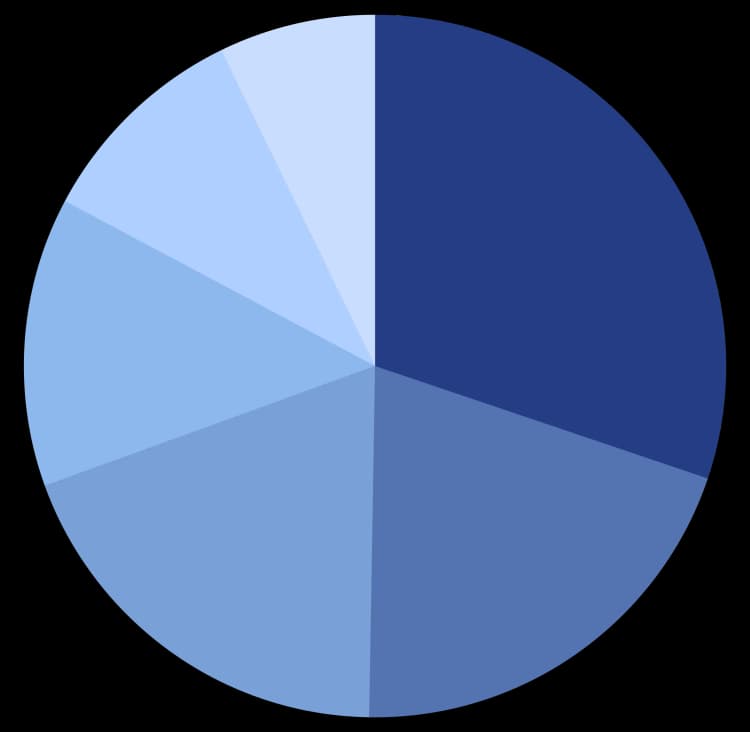

Staff by department

Percentages rounded to nearest whole number.

30%

of Omnex Staff are in dedicated compliance roles

30% Compliance

20% Systems/administrative

19% Agent/customer support

13% Collections/treasury

10% Accounting

7% Sales

Our History

Our History

Giromex, Inc. is founded by Juan Carlos Lebrija in San Diego, California.

Who We Are

Our Team

Darren

United States

Stephen

Philippines

Diana

Dominican Republic

Lam Vu

Vietnam

Bineta

West Africa

Fabiola

Ecuador

Omar

Mexico

Claudia

Brazil & Colombia

Marion

France

2021

Summary

Cash

Debit Card

Economic/Reputational Risk Control

- Omnex maintains over 10M USD in Surety bonds that ensure payout of transfers.

- Over 32 years in business providing services, Omnex has processed over 50 million money transfer transactions with positive reputational scoring.

Compliance Verification

- Risk-based regular mystery shopping.

- Risk-based verification by VCI (Visual Compliance Inspections) annual with retention of photographic evidence of compliance.

- Annual online training & testing for individual tellers.

- Automated disconnection for failure to train or unacceptable testing results.

- PCI Inspection added to VCI (Visual Compliance Inspections) 2019.

PCI Compliance

- Change system defaults on initial setup.

- Allow only secure and required traffic over POS network.

- Keep the equipment in a secure area and perform period checks for signs of tampering.

- Ensure personnel are fully trained to operate the POS system.

- Make sure any connected computer (terminals only at this time) equipment runs AV software and is scanned regularly.

- Adhere strictly to information retention policy.

Store Management Risk Control

- National Background checks for all location owners.

- National credit bureau and Lexis/Nexis review for reputational, ownership and lien related matters.

BSA/AML compliance

Ensure Five Pillars:

- - BSA/AML program

- - Independent Review

- - Training

- - Risk Assessment/ Risk Adjusted Procedures

Transactions Analysis:

- - Aggregation/Rule-Based

- - Post Transaction Review

- - Regulatory Filings (SAR/CTR filing)